Best Reserve rights Wallet

Looking for the best reserve rights wallet?

To authorize a transaction, simply tap any one of the four X1 Cards on the X1 Vault device. This design ensures that your funds remain secure and accessible even if you lose up to three components.

Cypherock X1 offers a robust and user-friendly solution for long-term Reserve rights storage with over 18,000 coins and token support across multiple networks.

How to choose the best Reserve rights wallet?

Choosing the best Reserve rights wallet comes down to how much control and security you want. Some wallets are easy to use but leave your crypto exposed. Others give you full control but require more effort. Let’s break down the types of Reserve rights wallets so you can find the one that fits your needs.

Why is Cypherock the best Reserve rights wallet?

If you want long-term Reserve rights wallet security, Cypherock offers a smart, simple solution. You don’t just store your Reserve rights. You protect it like a pro!

Buy, Manage, Swap and Track Your Reserve rights Effortlessly

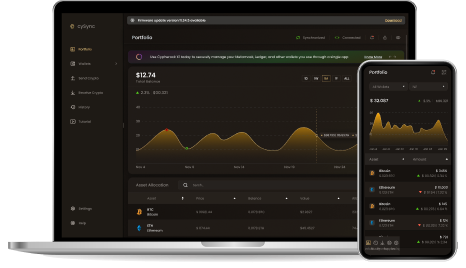

Managing your Reserve rights shouldn’t feel like a full-time job. With Cypherock X1 and the CySync app, it’s simple.

CySync is the companion app that connects you with Cypherock X1. It brings everything you need to one place, without putting your keys at risk. You can check your balance, track transactions, and manage your entire portfolio without exposing your private keys.

Users can also use it as a Reserve rights wallet tracker and stay updated on their holdings in real time. CySync also works as a RSR portfolio tracker to give a clear picture of your assets across all supported wallets. Whether you’re buying, holding, or trading Reserve rights, CySync gives you full control. All your transactions can be verified offline using the X1 Vault device. That means your RSR stays safe, no matter what.

Bank Grade Security for Your Reserve rights Wallet Seed Without Any Physical Backup

Cypherock X1 eliminates seed phrase risks, waving goodbye to vulnerabilities and potential failures. No more metal backups or paper backups needed to secure your RSR—we’ve redesigned security for your peace of mind.

Learn more…

Cypherock Provides Decentralised Security for Your RSR Wallet Private Key

Cypherock X1 hardware wallet decentralizes your RSR wallet private keys to give you 10× more security. Your private keys are split into five parts cryptographically and housed in five tamper-resistant hardware components—four X1 Cards and one X1 Vault. Losing one or two components doesn’t mean losing funds!

Learn more…

Use Cypherock X1 as a Seed Phrase Backup for Other Wallets

You can import seed phrases from up to four wallets like MetaMask, Ledger, Trezor, and Trust Wallet into Cypherock X1. Use it as a secure seed phrase backup for your Reserve rights. Sounds cool, right?

Learn more…

Effortless Reserve rights Portfolio Management with CySync Companion App

Simplify your Reserve rights journey with our user-friendly app CySync. Cypherock X1 is designed for both beginners and experts. Manage your Reserve rights and other cryptocurrencies securely, all in one place, without ever exposing your private keys.

Learn more…

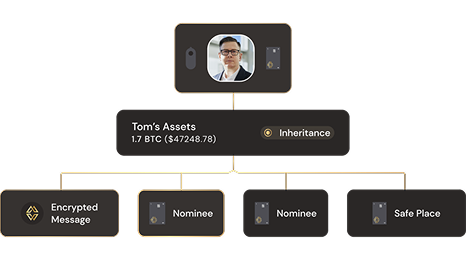

Plan your Reserve rights Inheritance, PIN, and Estate Recovery

With Cypherock, you can plan your Reserve rights inheritance and estate recovery to keep your assets safe and accessible to your heirs. Set up a secure PIN and a recovery plan that doesn’t rely on fragile paper or metal backups. Even if some hardware components get lost or damaged, your beneficiaries can still access your Reserve rights smoothly and safely.

Learn more…

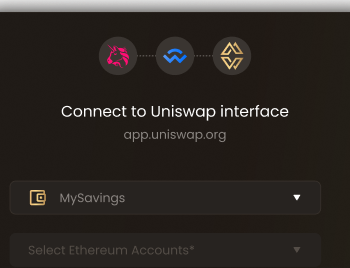

Seamlessly Connect With dApps

Connect with your favorite DeFi dApps effortlessly. Cypherock X1 integrates flawlessly with WalletConnect, ensuring a smooth and secure RSR wallet experience every time.

Frequently Asked Questions

What is Reserve rights?

What is a Reserve rights wallet?

How to send RSR to another Reserve rights wallet?

How to receive RSR in your Reserve rights wallet?

What is a Reserve rights wallet address?

How can I securely store my Reserve rights?

Can I manage multiple cryptocurrencies in one wallet?

How can I recover Reserve rights if I lose my wallet?

What security features should I look for in a hardware wallet?

Buy the best hardware wallet today