It is funny to witness what once was a go-to-way to have your startup investable (you only needed a whitepaper to raise millions!), has now reached a stage where people are questioning the very advantage of using a Blockchain in the first place. Weak hands in the Blockchain industry have left the space for good & the ones who chose to stay, are finding reasons to stay longer. Through this article, I hope to justify this winter to some extent & explore ways where we could hope for the good old days to come back again.

The crypto ecosystem has reached a stage where speculation single-handedly no longer drive the price movements. This is pretty evident from the fact when Ripple got listed by Coinbase recently. And the stakeholders in the ecosystem today have been asking the same question ever since the bull run of 2017, “When moon”?

No one knows it, yet everyone predicts it. ICO as the business model failed I believe. Most of the remaining one just don’t realize it yet. No one is practically investing in protocols today. Apart from the few, investors are asking for real business models in the token economy of a project. That is a fundamental problem. Investors have investors themselves. Their main focus is to generate the ROI for their funds. And hence in the ICO model, the founding team behind the token tends to monopolize the coin supply. This becomes an inherent conflict of interest with decentralization and hence a hindrance to user adoption.

With all due respect, I hope I am proven wrong in the future. Crypto economics and mechanism design seem to be a relatively new field of research given the massive interest from Crypto enthusiasts & engineers in the space. There is no one more excited than me to see it succeed. This is to the Crypto entrepreneurs from a Crypto entrepreneur himself!

Most of the people try to bracket Blockchain just as a technology. They tend to think it as a plug and play solution with the ability to decentralize anything it gets applied to. It cannot be further from the truth. In fact, an SQL database is a much better and efficient solution for most of the problems people try to solve using Blockchain.

Rather, a blockchain is infact a civil movement driven by its community of users, backers, and validators. People should value the security of the chain and decentralization part of the project more than how advanced the tech is. It is driven by time, has the built-in Lindy effect and hence cannot be growth hacked. Atleast not happened as of yet. Steller tried to do it. Still hasn’t climbed the market cap leaderboard to jump to a conclusion about its effectiveness. This aptly suggests why Bitcoin still holds the #1 position when it comes to market cap despite having possibly the most primitive tech in the whole space. When it comes to believing in a coin, true Bitcoiners never really tend to support any other coin. This becomes evident from the fact when for the first time hardcore Bitcoiners supported another cryptocurrency publicly. Unsurprisingly, this came at the expense of zero incentives for founders/developers working on that coin since the last 2–3 years which I personally sympathize with.

Apart from the community dynamics, the asynchronicity of decentralized public blockchains introduces unexpected behaviors into the network equations (hacks, 51% attacks, hard forks) which results in unfavorable consequences.

Hence what this points us to is that there are a lot of factors in deploying a decentralized public blockchain which is out of control of the founders and it is futile to predict the adoption of a cryptocurrency and so forth the money flowing into these assets.

It has almost been 10 years since the inception of Blockchain, it is still pretty unclear what unique features does it provide over a standard database. From what I personally could infer from the last 10 years of its existence, it is a censorship resistant, global, speculative asset building platform represented through a shitty and slow decentralized data structure with the ability to remove the central authority in a network. Quite a mouthful. Let’s break it down bit by bit.

Most of the things that are censored by the governments are infact morally incorrect too; child pornography, human trafficking, domestic abuse, and countless others. But libertarians, on the other hand, argue acts like Gambling, money printing, drugs which may only cause self-harm should be kept out of Governments’ say. Coming to the global aspect of things, most of the assets tend to be localized, limited to one country due to varied differences in the legalities around them. And every asset is inherently speculative in nature if it is available in open markets. But the feature that creates the most hype is the ability to decentralize a network which was taken advantage of by the smart money to rip the naive retail investors in the 2017 bull run. Sadly, most of the projects were outright scams and/or centralized, practically none of them has delivered and probably most won’t.

So as far as the use-case is concerned, the only global decentralized monetary system really ticks all of the stated checkboxes though it still needs to be proven at scale.

A lot of buidling going on in the space, whether for good or not. Bear markets make way for real buidlers to work on the technology peacefully. The lightning network went live in March 2018. They are expected to complete the version that is user-friendly for a non-tech person by the end of 2019. We can expect other layer 2 scaling solutions like Raiden network, Connext network to take mainstage this year. Blockchains with better interoperability, flexibility, privacy and scale like Cosmos, EOS, Grin, Holochain etc. are seeing significant traction even in the bear market.

Private Blockchain efforts from big corporate gains like JP Morgan, Facebook & Telegram have made headlines in 2019. Whether their efforts generate real value for the ecosystem is yet to be decided on, but they sure bring in more visibility from the non-crypto natives to this space. STOs is another area which is getting preferred in 2019 over ICOs but there are literally more STO exchanges than STO tokens themselves which sums up the interest it has garnered over the months. Plus, it is hard to conclude any real value that it adds over some other financial instruments available globally. Then Binance released their DEX in February. The validator nodes are controlled by Binance but it offers trading of the assets with hardware wallets directly and high tps which is still a better model than completely centralized exchange. There is a chance that these experiments succeed or maybe die out completely, but they surely provide incremental improvements in the space which is needed to push the intellectual boundaries of what can be possible and may exist too someday.

Talking about Bitcoin, Tone Vays & Murad Mahmudov have predicted Bitcoin to go to as low as $1500 , lower than the current price of $3500 . Technical analysis almost does not work for Bitcoin, given the absence of regulations on the exchanges. Digital assets traded by the institutions make no impact on the asset’s price since they trade through OTC trading desks. Hence positive price movements on Bitcoin is not expected until atleast the ETFs get approved.

Most of the people have been asking around the real problems that Blockchain & Crypto solves. There have been countless pilots around the conceived use-cases of the technology, yet almost none of them has been a success so far. My personal thesis is more focused around the fact that until the average consumer sees these assets as usable rather than labeling them as speculative, the adoption won’t really grow. Till these assets remain speculative in the open markets, institutional investors will always be able to profit off the retail investors and the space will eventually move towards pure quant strategies as is with the case with traditional financial instruments traded on National stock exchanges. So, I personally expect prices to rise if there is an actual use-case that is ‘enabled’ through Blockchain and is usable by a non-tech savvy user.

“We will enter the next crisis with a banking system that is stronger than it has ever been. The trigger to the next crisis will not be the same as the trigger to the last one — but there will be another crisis.” — Jamie Dimon

Another one of the thesis that I believe will help rally the prices of the digital assets is if there is a major financial crisis in one of the big superpowers of the world. In such a scenario, Crypto will be able to hold a better position than other asset classes due to its global liquidity. It won’t be that hit as other localized asset classes and hence act as the best hedge in the situation. Global sovereign debt has ballooned by 26 percentage points of GDP since 2007. Global banks like J.P. Morgan predict it to be in 2020.

The financial crisis is not a situation I personally vouch for, but in case it arrives, it will surely help the crypto ecosystem.

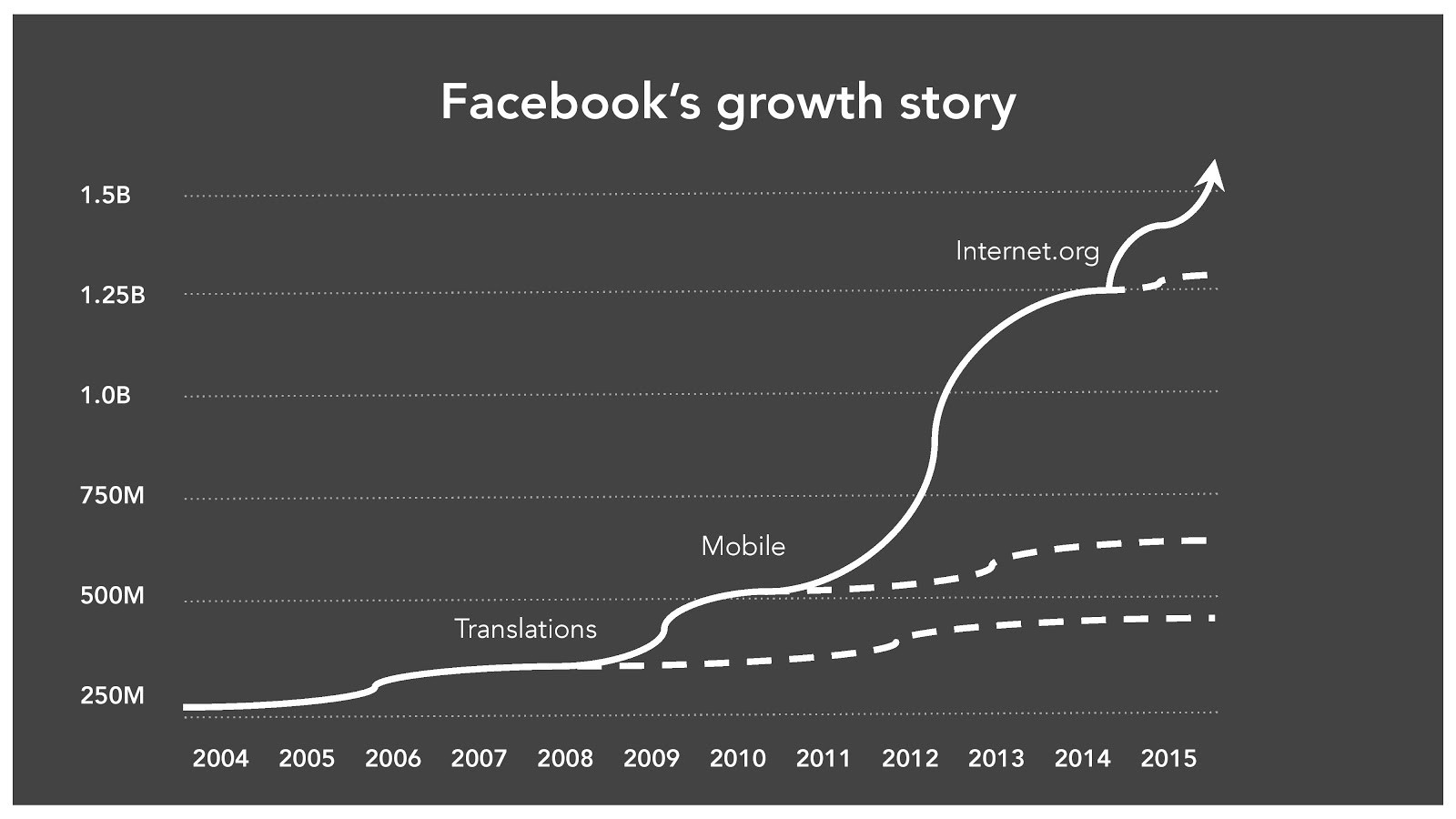

Gustaf Alströmer lecture slides

Gustaf Alströmer lecture slides

Social networks growth hacked user attention through psychological feedback loops. They used data to drive user growth in iterative cycles. Facebook’s journey has never been a linear one to reach a billion users. They experimented with novel strategies to acquire any new set of customers adapting to varied market and ecosystem changes.

Applications are easier to change dynamically to hack growth compared to a protocol which is inherently static. Hence there is generally no strategy for a protocol to grow according to the needs of the current market given that governance surrounding the development of decentralized networks is difficult, questionable and in active research. There is a need to figure out ways to pull non-crypto users into the space. Speculation is definitely one of them, but it still fails to attract the majority of the users due to risks involved with the same.

Remittance services for developing countries could be one of the first use-cases that take off. Facebook is reportedly looking to provide remittance service for non-residential Indians to send money back to India, at reportedly cheaper transaction fees through the use of Blockchains. Even though it does not really solve the bigger problem, it does help non-crypto people to have a better image towards the space. Not everyone can be their own bank, but what we do need is a better way to bank.

There is a need for global standards around the regulations in these assets. Other non-crypto assets are heavily regulated, have fixed market timings and have local laws governing them. Crypto, on the other hand, is global and has a 24/7 open market. Additionally, it is very difficult to regulate them. Hence there is a lot of uncertainty from the regulators about the working of these assets and ways to control them. Until there are a global standard and regulations about these assets, the non-crypto users will always be discouraged from interacting with them even though these assets are censorship-resistant. Having clearer tax regulations and fairer media propagation around assets will be a better push towards rise in prices.

There needs to be a fairer, state independent, technology-driven media house that has the attention of the non-crypto users to educate them about money. Most of the news broadcasting channels atleast in India have an indirect influence of the political parties which results in biased propagation of thoughts amongst its audience. Most of the people as a result only see Bitcoin as a mechanism to fund illegal activities, and the bigger narrative of non-confiscatable sound money separate from the state never really reaches their ears. Personally for me, Mike Dudas and his team at The Block has so far been an unbiased media house for this ecosystem. An emergence of a television media company which covers Bitcoin as currency & not as an asset, and has the reach the non-tech audience can be a catalyst for crypto summer. The media company could help give rise to a movement against the malpractices of banks in the global monetary system similar to the nature of the Facebook scandal towards privacy and data ownership.

Speculation will inherently be there in the space. The governments might somewhat regulate the centralized exchanges, but there is no way around on a decentralized one given it exists someday. But the real buidlers do not really focus on the price action too much. I personally believe that in a relatively new technology, infrastructural improvements are always needed before they can be used by the majority. In the current state of affairs, everything is infact dependent on Bitcoin and the price around it. And if Bitcoin is to succeed, it is not doing so with the current infrastructural problems such as hacks, recovery issues, inheritance problems and others that exist. At Cypherock, we envision to help disrupt the current financial system by increasing the adoption of digital assets through better key management solution. We believe there is a need for a better recovery system for the assets.