“The blockchain is an invention dating back to around 2009 which combines a few things like public key cryptography, peer-to-peer networks and most importantly the solution to an old computer science problem called a Byzantine generals’ problem. What that solution allows you to do to groups of humans who are anonymous and don’t know each other to establish trust with each other and that is a fundamentally very very important thing because in human history we’ve only had a few ways to regulate large groups of humans. We’ve done that either through having a democracy where it’s one person one vote or an aristocracy where an elite is in charge or a monarchy or a king or dictator is in charge or corporations in charge. And now to that we’ve added sort of a fifth way which is groups of people can achieve consensus with each other on the Internet even though they don’t know each other and unlike a democracy it’s merit-based, it’s based on what you provide into the network.”

— Naval Ravikant @ GS

Blockchain, for the first time through Bitcoin, enabled sustenance of a network without a central authority. What it opened was a wide array of possibilities never even thought of before, the biggest being the transfer of value in a decentralized way on the World’s biggest network, the Internet. But with a new architecture shift came new challenges for its mass adoption. From a user’s standpoint, the way you store it is different, the way it is transacted is different, the way it is verified is different and the way it is accessed is different. Accessing the decentralized ecosystem without trusting anyone still remains daunting for an everyday user.

Comparing the Bitcoin blockchain to the banking system, it points us to two major differences. Firstly, the transactions are reversible in the banking system and the banks maintain the KYC/AML of the customers. So if a hacker manages to hack your account and transfer funds into his own account, the banks will be aware of the transactions. Since they have the control of the database, the transaction can be reversed and the hacker can be tracked down to take action against him. But in a Blockchain based network like Bitcoin, since there is no central authority and no KYC/AML of the users, the transactions are irreversible and there is no mapping between the real identity and the pseudo-anonymous identity on the Blockchain. Hence if a hacker gets access to your Blockchain account, the funds will be gone forever and there is no way to recover them back ever again.

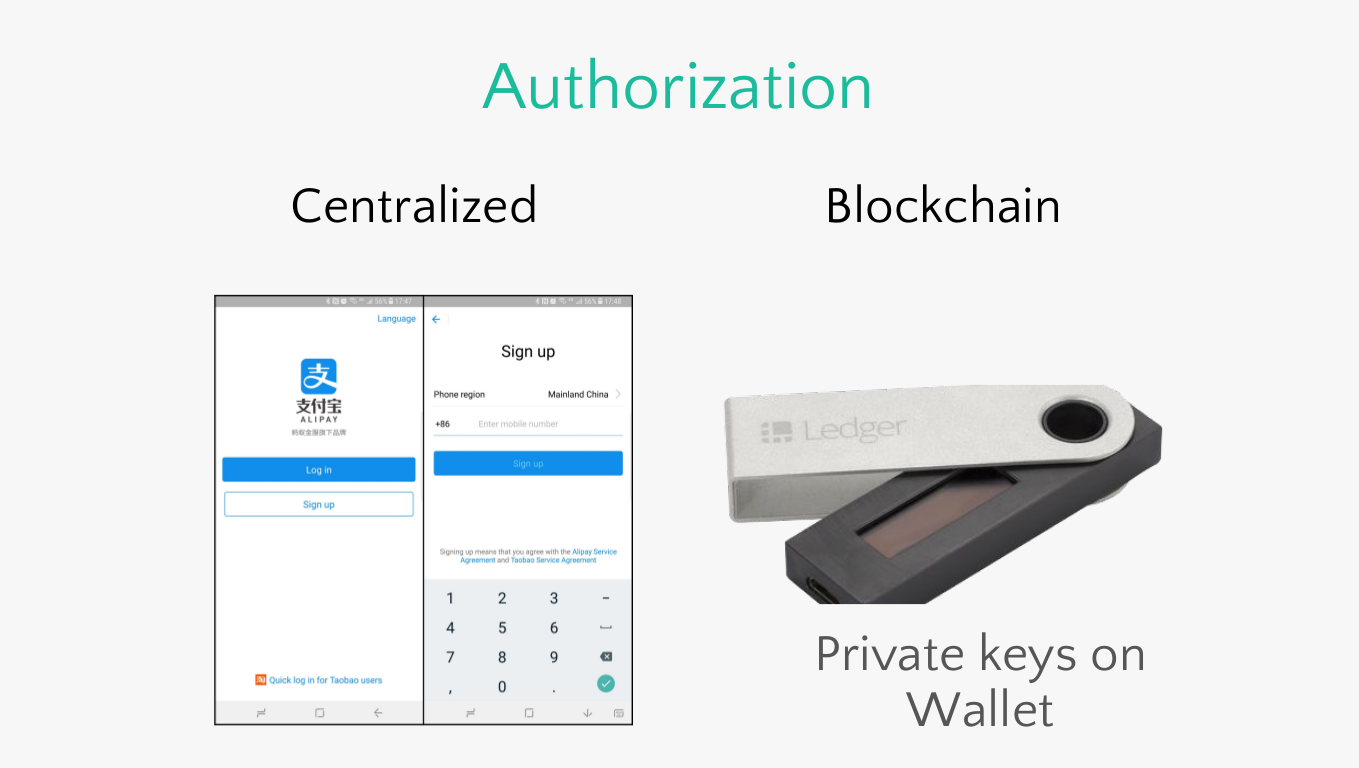

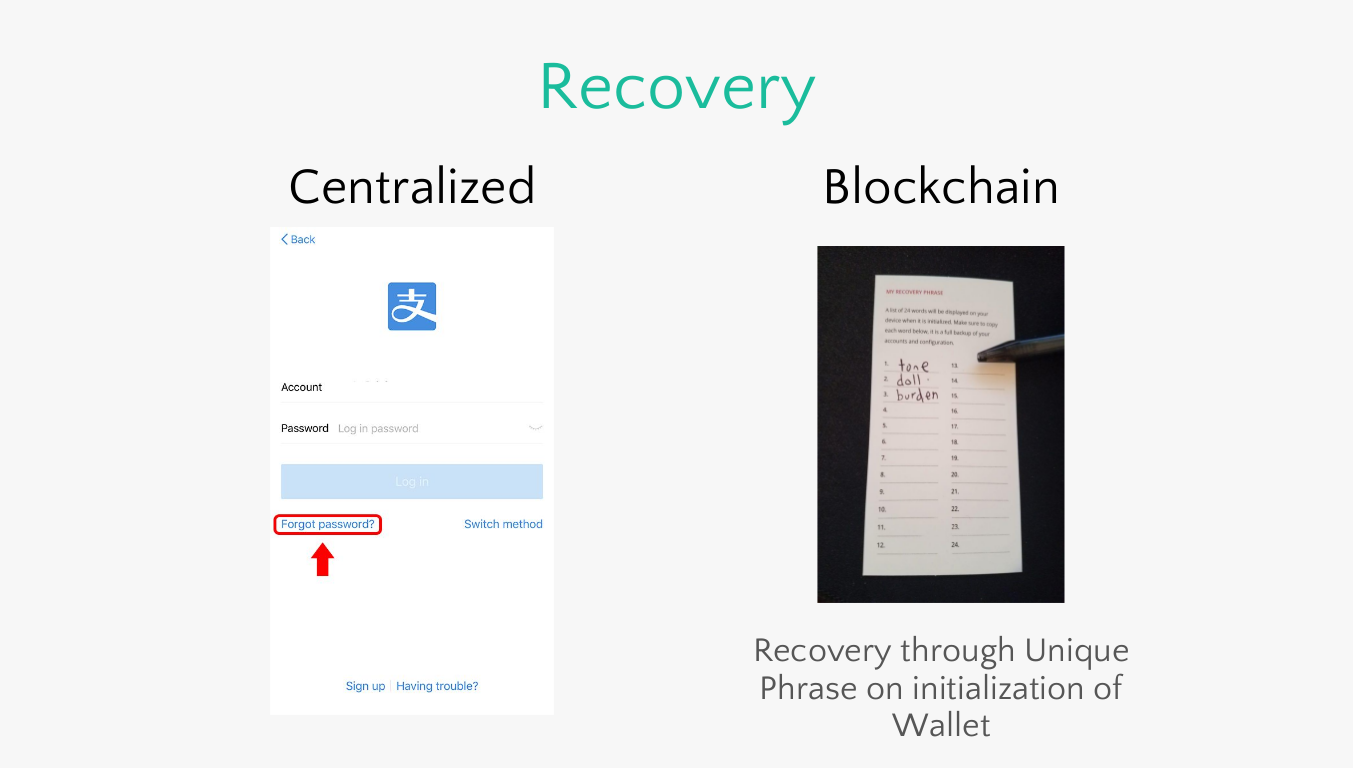

Every network in the world has two components, its authorization and its recovery in case the authorization fails. The authorization into a network contains a publicly known information and private information mapped to it. The recovery is required in case the user loses access to private information. In a centralized network like Facebook, the username is the public information and password is the private information which is stored in their database. In case the user loses access to his password, he can simply request Facebook for a link to reset the password. But in a decentralized network like Bitcoin, the pair of public key and the private key generated through a mathematical operation is the public and the private information. Since the network has no central authority, there is no corporation like Facebook to recover the keys for you. Hence in a decentralized network, both

the recovery and the authorization is the user’s responsibility.

The recovery process of the decentralized networks works very differently compared to a centralized network. In a decentralized network like Bitcoin, the private keys are encoded into human readable words which the users can write down on a piece of paper and store it somewhere safe. Now in case, the user loses access to his private keys, he can decode his private keys back from the recovery words and restore back his funds. The user today uses a separate device called a hardware wallet to protect the private keys. But on the other hand, the same private keys in the form of recovery words are left exposed on a piece of paper. In theory, that just shifted the attack vector from private keys to the recovery phrases. It exposes most of the problems again which it was intending to solve in the first place such as physical attack and erosion due to environmental factors. Inheritance of the assets and a greater learning curve for a decentralized network compared to a centralized network still remains a big enough barrier to entry for the glorified “Largest Wealth Transfer in the History of Humanity”.

As counterintuitive as it may sound, but the further you are from your keys, the more secure the funds are. Now if your private keys or even if a part of the wallet (multi-sig wallets in other words) is kept away from you, the system becomes more difficult to transact with on a daily basis. This brings us to the next point, it is okay to have one intermediary for these digital assets rather than having multiple like in a traditional banking system. It will be a daunting task for most of us to be our own bank. And therefore even if the user owns the private keys, it is advisable to give some control away to help out in cases of recovery and inheritance like situations.

The value of cryptocurrencies has always been a function of ease of use. Users who bought Bitcoins in the earliest days had to go through a plethora of technical hurdles before they could own one and store them safely. As it got easier to buy and securely store these assets, it allowed more and more people to join the system and own some themselves. Concluding the whole argument, if the world needs to see a faster adoption of the decentralized networks, the users should have a lesser burden than they face today in order to securely store their digital assets. This is something I personally feel is a fundamental infrastructure problem that needs to be fixed and it has been a personal mission of mine to do that. Along with my team at Cypherock, we have been making baby steps everyday to decrease the technical barriers of securely storing these digital assets for a non-tech savvy user thereby increasing its value and adoption over time. We will soon be launching our first product to secure the recovery phrases of the wallets.

Pay us a visit at https://www.cypherock.com and subscribe if possible. You won’t be disappointed with what is there to come. Peace.